A Simple Solution For

Retirement Income & Preservation of Principal

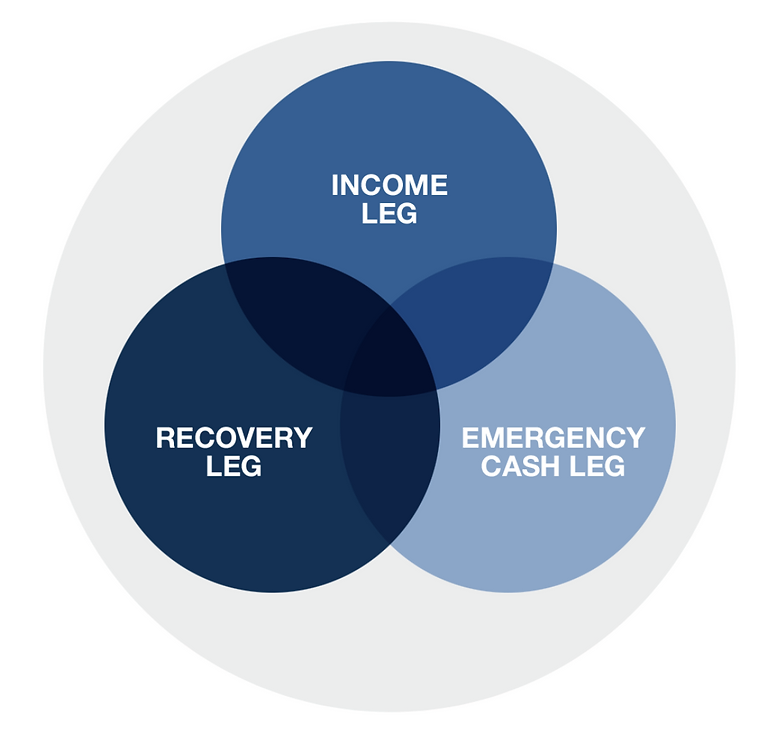

What is a Lifetime Income Portfolio?

A Lifetime Income Portfolio is a retirement income planning model that’s tailored to your individual priorities. Our goal is to help you generate reliable retirement income, preserve your principal, and ensure liquidity for emergencies, all while minimizing volatility and providing predictable income.

INCOME LEG

This leg of the portfolio is designed to generate reliable income throughout your retirement years. We work with you to create a sustainable income stream that lasts a lifetime.

EMERGENCY CASH LEG

Unexpected expenses happen, and we want you to be prepared. This leg provides quick access to cash reserves for unforeseen events.

RECOVERY LEG

We know that markets can be volatile, which is why we’ve created this leg to help you recover from downturns. We actively manage this portion of your portfolio to provide growth potential while minimizing risk.

By dividing your assets into smaller, specifically designed sub-portfolios, we can create a more stable retirement plan that’s tailored to your unique needs. Schedule a call with Amanda today to get started on your personalized retirement income and preservation plan!